You can save some money and have a more affordable payment if you pick to purchase a used car. There are however, some compromises to purchasing used, too. There are some 0% and other low-rate financing deals offered for used cars at shorter terms, such as 36 months that could decrease your payment if you qualify. Many people go buying a car and discover one they like prior to they think of funding. That's backward. You're more most likely to fall for car dealership sales tactics and purchase a more expensive cars and truck than you can manage when you shop in this manner. Instead, get preapproved for a loan with a bank, cooperative credit union or online loan provider.

With a preapproval, you'll understand just how much you can borrow to spend for the vehicle and what the month-to-month payment would be. You'll have a loan quantity and rates of interest that you can use to compare with the funding alternatives from the dealer and other lending institutions. You'll be prepared to make a notified decision when you discover the automobile you want. Lenders search for a high credit history for an 84-month loan term, so check to see what your credit may be before applying. That method you'll know which loan providers may give you preapproval. With simply a little preparation, you can get preapproved by a bank, cooperative credit union or online lender.

Lenders will use your creditworthiness to figure out the rates of interest they will offer you. Remember that the credit report for an auto loan is a little bit different from other loans. Get your information together before you visit a lender or use online. You'll require documentation like: Personal details, including name, address, contact number and Social Security number. Employment Details, such as your employer's name and address, your job title and salary, and length of work. Financial information, including your present financial obligations, your living circumstance, what sort of credit you have readily available and your credit report. Loan info, consisting of the quantity you expect to finance and the length of the loan term you desire, along with any trade-in or deposit information.

Search for the finest car loan rates. If you're buying a cars and truck, numerous credit questions made within 14 to 45 days won't injure your credit rating any more than a single query would. If you're successful in getting preapproved, you'll get a loan quote that shows much you get approved for, the rate of interest and the length of the loan. You can utilize this information when you go shopping at the dealer. You'll understand just how much you can manage to invest on the vehicle. And you'll have the ability to compare funding deals. If you have less than great credit, a cosigner could help you get approved for a loan that you may not be able to get on your own.

Remember the cosigner is accountable for paying the loan if you don't pay it. That could negatively impact their credit score as well as yours. If the cosigner is a buddy or relative, make sure they know their commitment to the loan. Understand a couple of financing traps dealerships may use while you're purchasing a vehicle. If you can acknowledge what the dealership is doing, you can prevent paying more than you prepared. Research study the manufacturer's suggested market price (MSRP) of the car you're looking at, and any incentives that might be offered. The sticker rate can differ by trim when does chuck learn to fight levels and options, so research the alternatives you want.

What Does Finance Mean When Buying A Car - Truths

Be cautious of dealer add-ons that are frequently presented at the final stage of settlement, such as: Nitrogen in the tires, Upholstery and paint security plans, Vehicle service contracts, Window tinting, Window car identification number (VIN) etching bundles, Research study your automobile's worth on sites like Kelley Blue Book and Edmunds to see the marketplace cost for a trade-in in your area. If you still owe cash on the car, and specifically if you owe more than the cars and truck deserves, you might have less negotiating power. Do not lose sight of how much the vehicle will cost you through the life of the loan - How many years can you finance a boat.

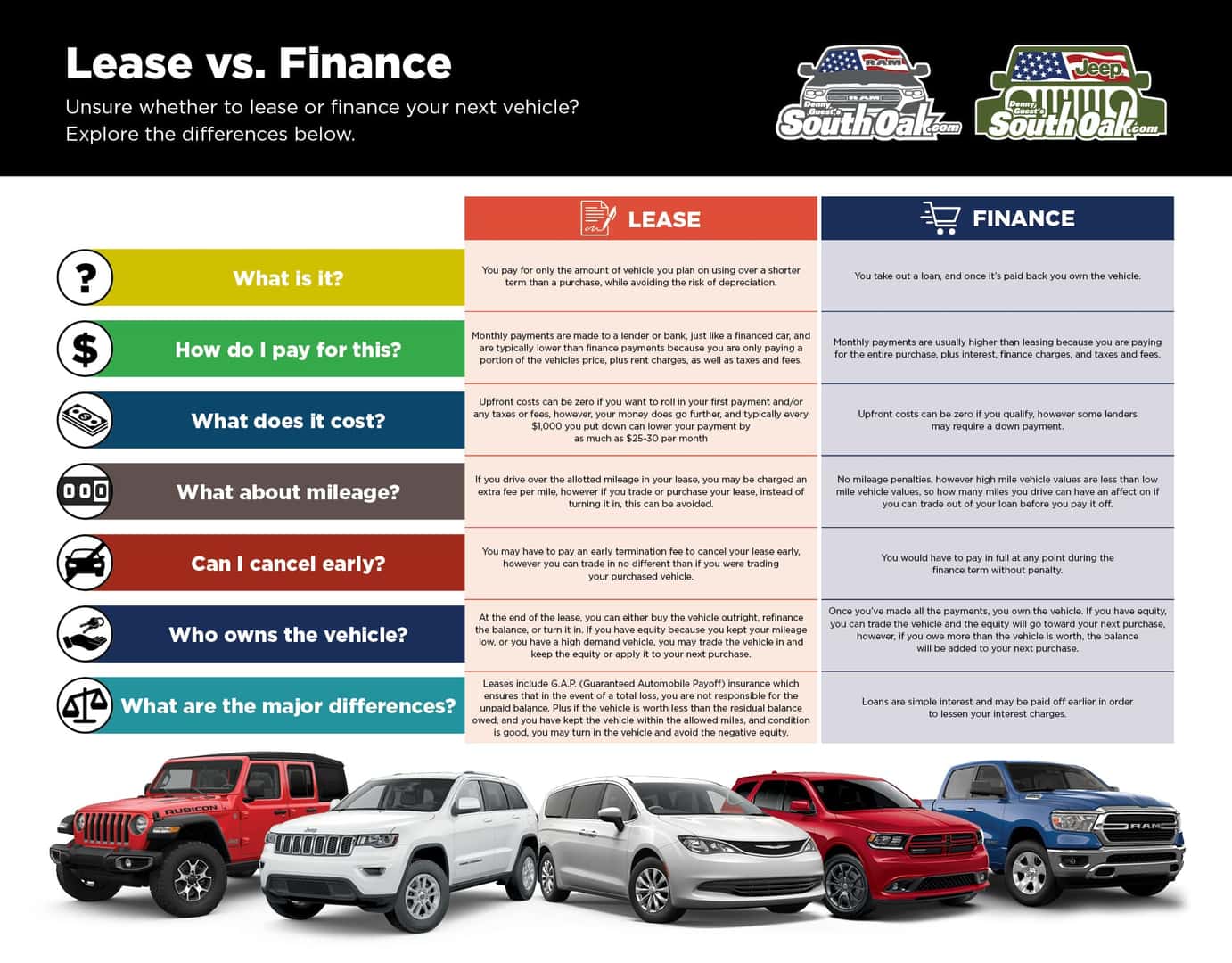

Look at the total expense of the purchase cost plus the total amount of interest prior to you decide on a loan term. This where the loan preapproval will help keep you on track. Have a common sense of how much you can obtain and how much you can pay for to pay every month considering your other commitments. Leasing can be a great alternative to a longer loan term. You could drive the very same car for a lower regular monthly payment, although leases are generally 36 to 37 months. Before you lease, comprehend the pros and cons compared to purchasing a vehicle.

One of the reasons is the typical brand-new lease payment is $466, while the typical month-to-month payment for a new loan is $569, Zabritski stated. Benefits and drawbacks of Leasing vs. Buying an Automobile, Payments on a lease are $100 less on average compared to buying, according to Experian. Payments are more for a loan, but when it's settled, you own the car. During the typical lease of 36 months, your automobile will be under full service warranty protection. You can buy prolonged guarantees or vehicle service contracts. Otherwise, you are accountable for maintenance expenses. You can move to a brand-new vehicle https://thingsthatmakepeoplegoaww.com/how-kitchen-remodeling-can-increase-your-real-estate-value/ at the end of the 36-month lease rather of being locked into a long-term cars and truck loan.

Leases generally enable 10,000-15,000 miles annually, and you'll pay more for additional miles, either upfront or at the end of the lease. Endless miles when you own the vehicle. You'll pay additional for upholstery discolorations, paint scratches, damages, and use and tear above the regular when you turn the vehicle in. Use and tear might lower the resale or trade-in value. The worth of the vehicle is set at completion of the lease and disallowing high mileage or excessive wear-and-tear, it should not change - How many years can you finance a boat. The automobile's value might not be as much as you owe on it and can continue to diminish as the automobile ages.

The average rate for new-car purchasers is 5. 61% while used car buyers pay a typical 9. 65%, according to Experian - What can i do with a degree in finance. You can normally fund a new car for 24 months as much as 96 months or eight years. The average loan term is 70. 6 months. Used automobiles can normally be funded as much as 72 months, although it can depend upon the age and mileage of the automobile.

The 8-Minute Rule for How To Cite Yahoo Finance Mla

If you're purchasing an automobile, you may need to fund your purchase with a vehicle loan. Car loans differ in length depending on the requirements of the debtor. The average vehicle loan length might be the most suitable length for your loaning needs. Some people pick longer loan terms because it enables them to make smaller regular monthly payments. Despite the fact that the payments are expanded over a longer period of time, each payment is more inexpensive. Let's say you are financing a $30,000 car over five years at 3 percent APR without any down payment and no sales tax. Monthly payments would cost $539 monthly.